With TurboTax Reside Business, get limitless expert assist while you do your taxes, or let a tax expert file utterly for you, begin to finish. Our small enterprise tax experts are all the time up to date with the most recent tax laws and will ensure you get each credit score and deduction potential, so you probably can put more cash back into your business. Small business homeowners get entry to unlimited, year-round advice and answers at no further cost and a one hundred pc Accurate, Expert Accredited guarantee.

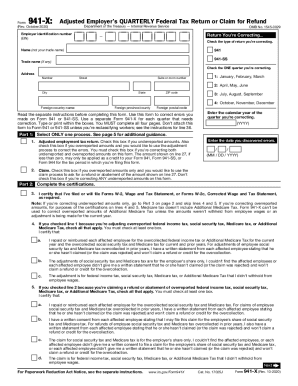

Select the mailing address listed on the webpage that is in the identical state as the tackle to which you’d mail returns filed without a fee, as proven subsequent. If you filed electronically, don’t file a paper Form 941. For extra details about submitting Type 941 electronically, see Digital filing and fee, earlier.

To turn into a CPEO, the organization should apply through the IRS On-line Registration System. For extra info or to apply to turn out to be a CPEO, go to IRS.gov/CPEO. Nonetheless, employers that pay qualified sick and family leave wages in 2025 for depart taken after March 31, 2020, and before October 1, 2021, are eligible to claim a credit score for certified https://www.intuit-payroll.org/ sick and household go away wages in 2025. Submitting a Form 941-X earlier than filing a Type 941 for the quarter might result in errors or delays in processing your Form 941-X. Type 941 is officially called Employers Quarterly Federal Tax Return, which is utilized by companies to report revenue taxes, Social Security tax, and Medicare tax withheld from employees’ paychecks. Additionally, it includes the employer’s portion of Social Security and Medicare taxes.

Particular Concerns When Filing Kind 941

15 for details about payments made beneath the accuracy of deposits rule. For 2025, the rate of social safety tax on taxable wages is 6.2% (0.062) every for the employer and worker. Cease paying social safety tax on and coming into an employee’s wages on line 5a when the employee’s taxable wages and tips reach $176,one hundred for the yr. Nonetheless, proceed to withhold earnings and Medicare taxes for the whole 12 months on all wages and tips, even when the social safety wage base of $176,a hundred has been reached. Section 303(d) of the Taxpayer Certainty and Disaster Tax Relief Act of 2020 permits for a payroll tax credit for certain tax-exempt organizations affected by certain qualified disasters not related to COVID-19.

Notify the IRS immediately should you change your small business name, business address, or responsible get together. If you utilize a tax preparer to fill out Kind 941, make certain the preparer reveals your corporation name precisely because it appeared when you applied on your EIN. Altering from one form of business to another—such as from a sole proprietorship to a partnership or corporation—is thought of a switch. Use IRS.gov/OPA to set up an installment plan and avoid penalties. Improve income, strengthen current client relationships, and entice new clients with our trusted payroll options that accommodate in-house, outsourced, or hybrid models. These credit are now not obtainable, and the associated strains have been eliminated or reserved in current versions of Type 941.

Common Submitting Mistakes To Keep Away From

- These credits are now not out there, and the associated strains have been eliminated or reserved in recent variations of Kind 941.

- Your workers may be lined by regulation or by a voluntary Section 218 Settlement with the SSA.

- This kind determines your payroll tax liability for the quarter.

- Earlier Than starting the form, you want your payroll data plus documentation for any taxable tips your employees report again to you.

Employers additionally must pay their own share of Medicare tax or social safety. This withheld money is reported to the federal government via Kind 941, a tax form from the Inside Revenue Service (IRS). The type helps businesses figure out how a lot tax they owe. You can file Type 941 electronically using the IRS e-file system or mail a paper return.

Department of Labor, credit score reduction states change annually based on which states have outstanding federal loans. Check the present year’s credit discount states before calculating your FUTA tax to keep away from underpayment. Seamlessly automate payroll, tax filings, and local labor law compliance in 180+ countries. Complete employment guides covering local labor legal guidelines, payroll, taxes, work permits and visas, go away and terminations in any country. You can view, download, or print many of the varieties, instructions, and publications you may need at IRS.gov/Forms. Otherwise, you can go to IRS.gov/OrderForms to put an order and have them mailed to you.

Marking these in your calendar or utilizing reminders keeps your quarterly filings timely. If you’ve made all your tax deposits on time, you might qualify for an additional 10 days, so it’s worth staying up to date in your payments. Your tax legal responsibility is not your deposits for each quarter. It’s the entire tax you owe based mostly on gross payroll minus tax credits and other adjustments for every month. Your tax legal responsibility for the quarter should equal the total on line 12. For Type 941, you’ll face a 5% penalty on unpaid taxes for each month the return is late, as much as a maximum of 25%.

Any remaining credit, after decreasing the employer share of social security tax and the employer share of Medicare tax, is then carried forward to the subsequent quarter. Type 8974 is used to determine the amount of the credit that can be used within the present quarter. The quantity from Form 8974, line 12 or, if applicable, line 17, is reported on line 11. For more details about the payroll tax credit, go to IRS.gov/ResearchPayrollTC. Also see Adjusting tax legal responsibility for the certified small business payroll tax credit score for rising analysis activities (line 11), later. For tax years starting before January 1, 2023, a qualified small business may elect to assert up to $250,000 of its credit score for rising research actions as a payroll tax credit score.

Authorized holidays in the District of Columbia are provided in section eleven of Pub. You can now file Type 941-X, Adjusted Employer’s QUARTERLY Federal Tax Return or Declare for Refund, electronically using Modernized e-File (MeF). For extra information on digital filing, go to IRS.gov/EmploymentEfile.

Just remember that the filing deadline all the time falls on the last day of the month following the tip of the quarter. This gives you one month to organize the shape before submitting it to the IRS. You’ll enter corrections beneath Part three and clarify every correction you made in Part four. The due date for Kind 941-X depends on if you found the error and should you over or underreported on taxes. Use Schedule R (Form 941) to allocate the combination information reported on Form 941 to every consumer. If you might have greater than 15 shoppers, full as many continuation sheets as essential.